California Solar Incentives, Battery Rebates & EV Charger Credits

From rugged coastlines to enchanting redwoods, from picturesque vineyards to dramatic deserts — California has it all. Home to more than 39 million people, the Golden State is a melting pot of culture, opportunity and natural beauty. But as the amount of carbon dioxide in the air causes our temperatures to warm, California is experiencing strains to its water supply, increasing wildfires, sea-level rise and greater smog in urban areas.*

To slow some of these harmful effects, the state has enacted policies to reduce the amount of carbon dioxide emissions in the air. Billions of dollars are being invested to mitigate changes to help our climate, from rebates on electric vehicles (EVs) and charging stations to solar mandates and tax incentives.

If you’re ready to save money on your utility bills, lower your dependence on gasoline, and reduce your carbon impact, then California solar incentives, battery rebates and EV charger credits can help you make those lifestyle changes sooner.

1. California Solar Tax Credits

With its abundant sunshine and high cost of electricity, California is the nation’s top market for rooftop solar energy. In August of 2018, California enacted SB 100, which set the target of achieving 100% carbon-free electricity by the year 2045 and a move to 60% renewable energy by 2030.

Because of that bill, the California Energy Commissions began requiring that all new single-family homes and multi-family dwellings up to three stories high, built in 2020 onward, to have solar panels installed (although there are some exemptions).

While the cost of solar in the Golden State has fallen 47% over the past decade, it’s still a significant investment. Homeowners who commit to solar energy may be able to take advantage of several California solar incentives and reduce the cost of clean energy adoption.

Federal Level: ITC for Home Solar

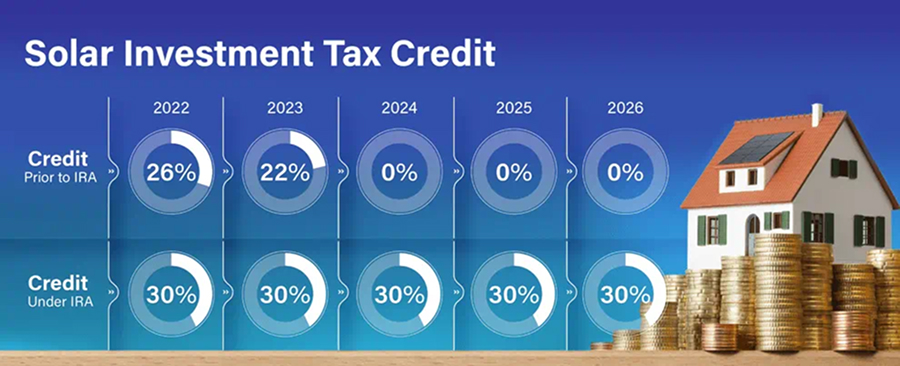

The solar investment tax credit (ITC) is one of the most important policies to support the widespread adoption of solar power in the United States. Since it was enacted in 2006, the ITC has been extended several times, helping the industry grow an average of 52% each year. With the passing of the Inflation Reduction Act in August of 2022, the ITC has been extended through 2032. After that, the tax credit will decrease to 26% in 2033 and drop to 22% in 2034 before expiring the following year.

The federal tax credit helps solar customers who have purchased a residential solar electric system (via cash or loan) to deduct 30% of your total solar installation costs. It’s not a tax deduction, but rather, it reduces what you owe on your taxes. The ITC can be rolled over for up to five years as long as the taxes you owe are less than the credit you earn.

If you’re considering going solar with a loan and you pay federal taxes, the ITC may enable you to get dollar-for-dollar reduction off the sticker price and can help you pay your system off sooner.

*At Sunnova, we don’t give tax advice. Please consult your tax advisor to determine the incentives that you may qualify for.

2. California Battery Storage Incentives

Installing solar panels in California may help you reduce your carbon footprint and reduce your electricity bills, but your solar power won’t stay on if the grid goes down unless you have a way to store it. In places like California that are prone to fires, public safety power shutoffs (PSPS), flooding and other severe weather events, solar battery backup is becoming more common — and rightfully so. Adding a battery to your solar system allows you to save the clean energy your panels produce and use that power at night, on rainy days when production is limited, or during a power outage.

As battery technology improves, solar storage is slowly coming down in price. Still, it’s a considerable upfront investment. Fortunately, there are battery storage incentives that you may qualify for.

Self-Generation Incentive Program (SGIP)

California’s Self-Generation Incentive Program (SGIP) offers a rebate for qualifying homeowners who install energy storage technology, such as a solar battery, that can operate when the grid goes down.

Local Level: EV Charging Incentives

While the national EV charger tax credit ran out several years ago, some utilities and municipalities have introduced their own rebates and incentives. These local incentives change often, as they tend to receive and run out of funding quickly.

Lower Your Cost of Solar, Storage and EV Charging in California

While the national EV charger tax credit ran out several years ago, some utilities and municipalities have introduced their own rebates and incentives. These local incentives change often, as they tend to receive and run out of funding quickly.

But solar credits and utility incentives won’t last forever. If you been considering solar plus storage and/or buying an electric vehicle to help lock in your energy costs — the time to act is now.

- NEXT: How to Choose the Right Home Solar System: A Step-by-Step Guide

- NEXT: Null